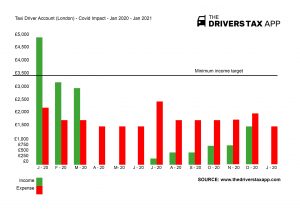

How’s this for a graph-ic representation of the true impact of Covid-19 on taxi drivers?*

You can plot the mini recoveries as the Tiers/Restrictions were tweaked, but sadly they were not enough to reach this driver’s Minimum Income Target of £3,500.

The Green columns represent this typical London taxi drivers income and the red columns, his expenses.

Of course, the £0 income months were as a result of lockdown.

Couple them with Rishi Sunak and local authorities’ stark failure to recognise the overheads taxi drivers have, unlike options for furlough that other businesses can use, and we have a crisis.

This taxi driver who owns a LEVC still had bills to pay, and the SEISS grant simply wasn’t enough to cover his expenses.

So he tried to get back to work, venturing out in July.

He expected it would be dead, and it was.

As the months passed, work started picking up, demand was still totally depressed, but there was at least, ‘light at the end of the tunnel’.

Then another lockdown was announced!

If this graph rings bells to you, please know that we are here for you.

Reducing your costs, increases your profit. FACT.

Whilst The Drivers Tax App can’t increase your demand, we can help you start increasing your potential for profits.

It begins with a swift cut of your accounting costs.

You can make a start right now by using our app to submit your 19/20 tax return for just £60.

Plus, you can even spread your next tax return costs over monthly subscriptions.

Talk to us today about how we can help, we’re here for you.

You can download this graph from our Facebook page to post or share with local authorities, they need to understand your costs.

*We’ve taken this example from our data and anonymised this London taxi owner/driver.